European Medical Cost Estimator

Estimate Medical Costs in Europe

Enter your travel scenario to see estimated costs for medical care in Europe. Note: This tool estimates costs without insurance. Always purchase travel insurance for protection.

Estimated cost: $0

These are average estimates for uninsured travelers. Actual costs may vary based on specific circumstances. European hospitals typically require payment before release.

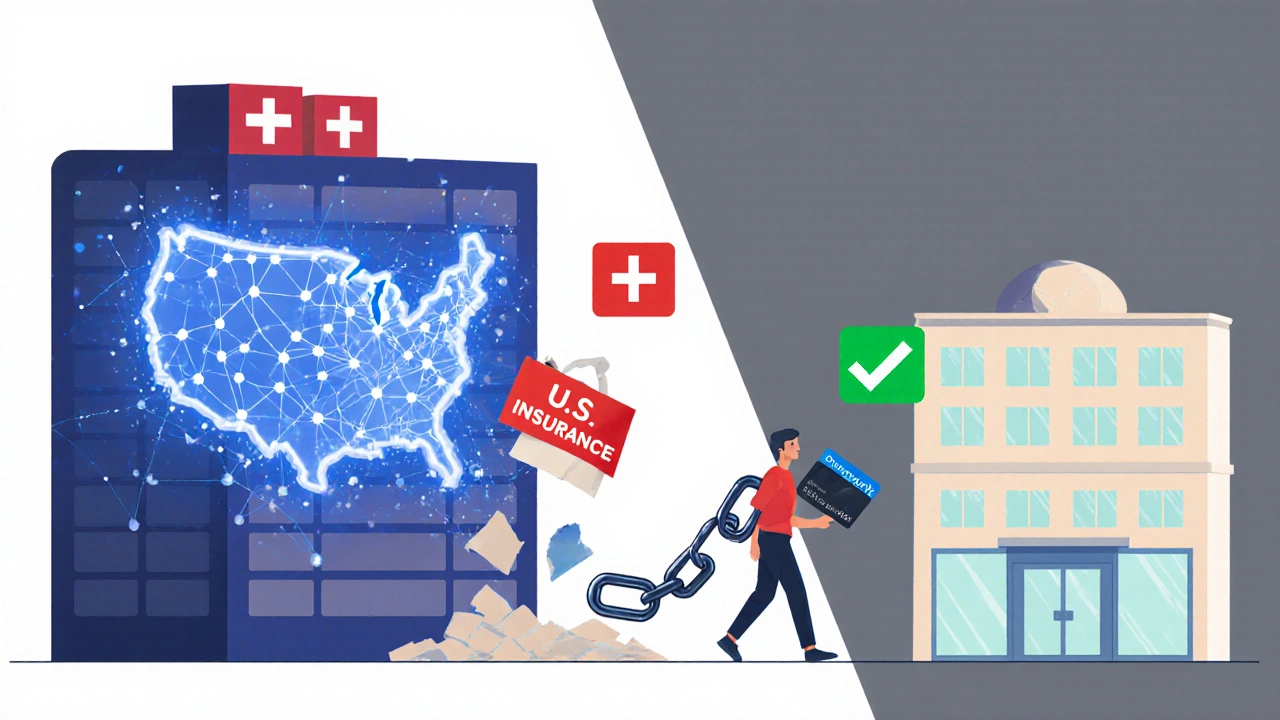

If you’re planning a trip to Europe and wondering whether your American health insurance will cover you if you get sick or hurt, the short answer is: usually not. Most U.S. health plans - whether through an employer, Medicare, or a private insurer like Blue Cross or UnitedHealthcare - are designed for care within the United States. They don’t pay for emergency or routine care overseas, even in countries with top-tier hospitals like Germany, France, or Spain.

That doesn’t mean you’re left completely unprotected. But it does mean you need to understand what’s covered, what isn’t, and how to fill the gaps before you board your flight.

Why U.S. Insurance Doesn’t Cover You in Europe

U.S. health insurance operates on a network-based system. Doctors, hospitals, and labs are contracted with your insurer to accept negotiated rates. Outside the U.S., those contracts don’t exist. Even if a European hospital accepts credit cards or offers English-speaking staff, they’re not part of your insurer’s network - and won’t file claims on your behalf.

Some plans offer minimal emergency coverage abroad, like a $10,000 cap for life-threatening situations. But even that’s rare. A 2024 survey by the Kaiser Family Foundation found that fewer than 15% of employer-sponsored plans include any international medical benefits. Medicare doesn’t cover care outside the U.S. at all, except in very limited cases like emergencies near the Canadian or Mexican border.

So if you break your leg skiing in the Swiss Alps or get food poisoning in Rome, you’ll likely pay out-of-pocket. And those bills can add up fast. A simple ER visit in Paris can cost $1,500. A hospital stay for pneumonia in Italy? Around $8,000. Without insurance, you’re on your own.

What You Can Do Instead

You have three realistic options: travel insurance, international health insurance, or paying cash. Each has trade-offs.

Travel insurance is the most common choice for short trips. It’s cheap - often $50 to $150 for a two-week vacation - and covers emergencies, medical evacuation, and sometimes trip cancellations. But it’s not a substitute for real health coverage. Most plans won’t cover pre-existing conditions unless you buy a waiver within days of booking your trip. They also cap coverage at $50,000 to $100,000, which might not be enough for serious illness or surgery.

International health insurance is what expats, digital nomads, and long-term travelers use. Companies like Cigna Global, Allianz Care, and GeoBlue offer plans that work in Europe and beyond. These cover routine care, prescriptions, and even chronic condition management. Premiums range from $300 to $800 a month, depending on age and coverage level. If you’re planning to stay in Europe for more than six months, this is the smart move.

Paying cash sounds risky, but many European hospitals offer upfront pricing for tourists. In countries like Hungary, Poland, or the Czech Republic, medical tourism is a major industry. A knee replacement that costs $50,000 in the U.S. might cost $12,000 in Prague - including hotel, translator, and follow-up care. Some clinics even partner with U.S. insurers to offer direct billing, but you’ll need to ask ahead.

What’s Covered in an Emergency?

Europe’s public healthcare systems are designed to treat anyone in an emergency - regardless of citizenship or insurance. If you collapse on the street in Barcelona or have a heart attack in Vienna, you’ll get treated. But that doesn’t mean you won’t get billed.

After you’re stabilized, the hospital will send you a bill. If you don’t have insurance, they’ll expect payment before you leave. Some hospitals will let you pay in installments, but many won’t release your passport or flight documents until the bill is settled. In extreme cases, you could be detained until payment is made.

That’s why carrying a credit card with a high limit is essential. Also, know that European hospitals rarely accept U.S. insurance cards. Even if you show them your Blue Cross card, they won’t know what to do with it. They’ll ask for cash, card, or proof of insurance from a provider that works in their country.

Medical Tourism: When Europe Becomes Your Doctor’s Office

More Americans are traveling to Europe not just for sightseeing, but for treatment. Dental implants in Hungary cost 70% less than in the U.S. Hip replacements in Poland are half the price. Cancer therapies in Germany use cutting-edge protocols not yet approved in the U.S.

But here’s the catch: if you’re going for planned care, your U.S. insurance still won’t pay. Some insurers offer limited reimbursement if you get pre-approval and use a certified international provider. A few, like Aetna and Cigna, have started pilot programs with European hospitals - but these are exceptions, not the rule.

If you’re considering medical tourism, treat it like a business decision. Get a detailed quote in writing. Ask if the hospital has JCI accreditation (the gold standard for international care). Confirm that the doctor speaks English and has experience treating U.S. patients. And always get a second opinion from a U.S. doctor before committing.

What to Pack: A Traveler’s Medical Checklist

Before you leave, do this:

- Buy travel insurance with medical coverage - and read the fine print. Look for at least $100,000 in emergency coverage and medical evacuation.

- Carry a copy of your medical records, including allergies, medications, and chronic conditions.

- Bring a letter from your U.S. doctor explaining your conditions and prescriptions - especially if you’re carrying controlled substances.

- Know the location of the nearest U.S. embassy or consulate. They can help you find local doctors but won’t pay your bills.

- Keep a credit card with no foreign transaction fees and a high limit. Debit cards often have daily withdrawal limits.

- Download offline translation apps. Google Translate works offline if you download the language pack ahead of time.

Real Stories: What Happens When Insurance Fails

One traveler from Texas got a severe case of pneumonia while visiting Lisbon. Her U.S. plan didn’t cover anything. She paid $11,200 out of pocket - using a credit card she didn’t realize had a $10,000 limit. She spent three weeks in the hospital and had to borrow money from family to cover the rest.

A retired couple from Ohio planned a six-month trip across Europe. They skipped insurance to save money. Midway through, the husband needed emergency heart surgery in Prague. The hospital demanded $48,000 upfront. They sold their car back home to pay for it.

These aren’t rare cases. They’re common.

Bottom Line: Don’t Rely on Your U.S. Plan

Your American health insurance won’t save you in Europe. Not for emergencies. Not for planned care. Not even for a simple doctor’s visit. That’s not a flaw in the system - it’s how it’s built.

But you’re not helpless. You have options. For short trips, buy travel insurance. For longer stays, get international health coverage. For medical treatment, research providers in advance and budget like you’re paying for a major purchase -because you are.

Europe has excellent healthcare. But you have to pay for it - and you have to plan for it.

Does Medicare cover me in Europe?

No, Medicare generally does not cover medical care outside the United States. There are very few exceptions - like emergencies while traveling between Alaska and Canada, or on a cruise ship within six hours of a U.S. port. For any other situation in Europe, you’ll need to pay out of pocket or have supplemental insurance.

Can I use my U.S. health insurance card in Europe?

No. European hospitals don’t recognize U.S. insurance cards. They don’t have access to your insurer’s network or billing system. Even if you show your card, staff won’t know how to process it. Always carry proof of travel insurance or cash/credit instead.

Is travel insurance enough for a long trip to Europe?

For trips under six months, yes - if it includes medical coverage and evacuation. But for stays longer than six months, travel insurance often expires or excludes pre-existing conditions. Long-term travelers should switch to international health insurance, which offers continuous coverage and includes routine care, prescriptions, and specialist visits.

What if I need emergency surgery in Europe?

You’ll receive treatment immediately - European hospitals are required to treat emergencies regardless of insurance. But you’ll be billed afterward. Without insurance, you could face bills of $20,000 or more. Always carry a credit card with sufficient limit and contact your travel insurer as soon as possible to start the claims process.

Can I get reimbursed by my U.S. insurer after paying out of pocket in Europe?

Only if your plan specifically allows it - and most don’t. A few high-end plans may reimburse you for emergency care after you submit receipts, but you’ll likely be reimbursed at a fraction of the actual cost. Don’t count on it. Paying upfront and hoping for reimbursement is risky.

Are there U.S. insurers that work directly with European hospitals?

A few do, but it’s rare. Cigna Global, GeoBlue, and some employer-sponsored plans have partnerships with select hospitals in Germany, France, and Spain. These allow direct billing and reduce out-of-pocket costs. Always check with your insurer before traveling - don’t assume you’re covered.

What’s the best travel insurance for Europe?

Look for plans with at least $100,000 in medical coverage, $500,000 in medical evacuation, and no exclusions for pre-existing conditions (if you need them). Providers like Allianz, World Nomads, and SafetyWing are popular with U.S. travelers. Read reviews, compare coverage limits, and confirm the insurer has 24/7 multilingual support.